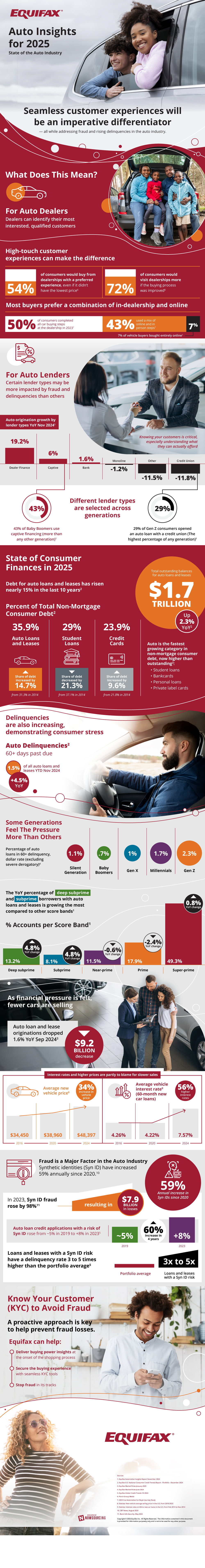

In recent years, financial pressures have mounted with many consumers. Since 2014, the share of consumer debt has changed drastically. The share of debt for auto loans and leases increased by 14.7% from 31.3% to 35.9%. During the same timeframe, credit cards grew from 21.8% to 23.9%, or by 9.6%.

With the amount of debt increasing, it’s no surprise that the total outstanding balances for auto loans and leases grew to $1.7 trillion, which is 2.3% more than last year. Part of this can likely be attributed to the quality of auto financing agreements and the underlying assets.

Auto Industry Trends

Prime and near-prime auto loans and leases fell by 2.4% and 0.6% respectively. On the other hand, subprime and deep subprime financing agreements grew by a whopping 4.8% each. The average price for a new vehicle has grown by 34% from 2016 to 2024 and the average interest rate for a new vehicle grew by 56% in the same timeframe.

Unfortunately, this level of debt pushes many to become delinquent on their car payments. As of November 2024, 1.5% of all loans and leases are considered delinquent, which is 4.5% higher than last year. This delinquency is felt disproportionately by Millennials and Generation Z, who also have compounding debt from credit cards and student loans.

Conclusion

To combat this, many people have turned to synthetic identities, or Syn ID’s. People use Syn ID’s to conceal their actual financing status in order to get approved for a loan or to get a better interest rate. Fortunately, new technology has come to rival Syn ID that can proactively detect and prevent fraud.

Companies now provide Know Your Customer (KYC) technology, which delivers real-time insights into customer buying power. The best way to make sure you know who you are doing business with is to take advantage of KYC technology and auto industry trends from Equifax.